Tag Archives: Streamline

Spring is around the corner, really it is, and it’s time to get your home in order!

Spring is around the corner, really it is, and it’s time to get your home in order!

Spring cleaning can be fun and easy if you follow some general guidelines, which are sure to get your home ready for the nice weather and looking as beautiful as the weather is about to. Kick the winter clutter to the curb with these spring cleaning tips.

Start With The Closets

Spring is here, and winter wear is no longer needed! It’s time to box up all of the winter boots, jackets, gloves, and scarfs until next season.

Starting your spring clean with your closets is a good tip, and will get you prepared for the rest of the process while creating more space and organization in the bedrooms of the house. This is also the perfect opportunity to create a “give away” box full of clothes that are no longer being worn. I always recommend the local Disabled American Veterans (DAV).

Reorganize: Bookshelves, Countertops, And Desks

Reorganizing is the perfect way to prepare your home for the spring and summer. Good clutter is common in many homes, like useful books that are interesting for guests to read or decorations that offer a sense of warmth and character to the home.

So pick up the fallen and leaning books on the bookshelf, reorganize your kitchen countertops, and de-clutter your home office. For busy home offices, purchase organizational tools like additional shelving units, compile and file away old bills and receipts, and toss anything else that is no longer needed or of any use.

Get Scrubbing: Removing Stains And Odors

Getting ready for spring means removing the stains, dirt, and odors that accumulated in your home over the colder months. First, you should start with wiping your painted walls with a wet cloth to remove scuffmarks and dust.

If the water doesn’t do the trick, you can try mixing a little dishwashing soap in with the bucket of warm water. You may even want to repaint certain high-traffic areas, like entrance halls and the baseboards around the front door.

Next, you can go for the floors. Having a fresh carpet cleaning is sure to kick-start your spring cleaning; this may be something that you wish to have done by a professional. To make the most out of your carpet cleaning, have it scheduled for when the kids are out of the house for a while, and wait until the worst of the weather is over.

Make sure the kids take their shoes off inside, but get them to leave their socks on to avoid natural oils from getting into your freshly cleaned carpet. Vacuum area rugs in the same fashion, and mop the kitchen and bathroom floors at the same time you clean your hardwood floors.

Give the showers, bathtubs, and toilets in the house a good scrub. In the kitchen, empty the fridge and freezer of their contents, and give the inside a good scrub down as well.

Once the tidying, de-cluttering, and scrubbing are done, you will get to enjoy the fun part of spring cleaning: spring decorating! And while you’re at it, why not buy yourself and your home some spring flowers for a job well done.

If you’re doing a big spring clean this year because you’re looking to sell your home, these tips will get your home ready for any buyer’s eyes. And, don’t discount the value of a professional home staging company. Contact me today to get more tips on buying or selling a home, or the referral to a great real estate agent.

Owen Riess

NMLS # 543286 Equal Housing Lender

Marketplace Home Mortgage NMLS # 1082

Leave a comment | tags: America, Disabled American Veterans, Fannie Mae, For Sale, Freddie Mac, God, Home, Home Ownership, Homeowner, House, Listing, Marketplace Home Mortgage, Minnesota, Mortgage, Owen, Owen Riess, owenriess, quote, real estate, Realtor, Refinance, Reward, Riess, Social Media, Spring Cleaning, Streamline, Veteran | posted in Existing Homeowners, Family & Friends, First Time Homeowner, Frist Time Homebuyers, Mortgage Professional, Realtors, Social Media, Social Media for Realtors, Social Medis for Mortgage Originators

Why You Need a Buyer’s Agent

Why You Need a Buyer’s Agent

A buyer’s agent is the real estate agent that represents the buyer in the purchase of a home.

Almost all home buyers start looking for homes online and visiting open houses. The real estate agent listing the home is the listing (selling) agent. They are under legal contract with the seller to represent the seller’s best interests in the transaction.

There are many reasons why you need a buyer’s agent to represent you:

- They will look for a home on your behalf that meets your needs. This will save you time and money. They can send you current and new listings for the criteria you select.

- They are qualified negotiators that are working for you. They will pull together all of the information about what other houses are selling for that are similar to the one you want to buy so you don’t pay too much.

- The Buyer’s Agent is someone to buffer you from pushy Sellers, pushy Listing Agents and anyone else who is not obligated to look out for your best interests.

- Someone to help you understand what you must do to protect yourself in a real estate transaction so you don’t end up with a crappy house that you paid too much for.

- They can arrange private showing where you and they can review the home honestly and without sale pressure from the listing agent.

- Someone to explain the whole process to you, from making the offer to getting the deal closed.

In working with many different buyers agents over the years, I would recommend that you meet with a few agents to see who you want to work with and feel confident in. This is an important choice and you need to feel that they are working for you at all times. Attributes to consider in selecting a buyer agent:

- Do they communicate open and honestly. Do they return phone calls and email promptly? Are they honest about a home that is not what you are looking for?

- Do you genuinely feel that they are working for you?

- Are readily available to meet with you and show homes?

- Are they familiar with the communities you are searching in or are they willing to research to get the answers to all of your questions.

If you do not feel they are working hard for you it would be a good idea to look for a different agent, one that will consider your objectives, and help you to achieve them.

If you have any questions or would like to meet an excellent buyer’s agent please give me a call at 952.837.3366.

Thank you!

Owen Riess

Marketplace Home Mortgage, LLC

oriess@marketplacehome.com

NMLS # 543286

(952) 837-3366

Equal Housing Opportunity Lender

Leave a comment | tags: America, Buyer's Agent, Facebook, Fannie Mae, For Sale, Freddie Mac, Friend, God, Home, Home Ownership, Homeowner, House, LinkedIn, Listing, Minnesota, Mortgage, NMLS#543286, Owen, Owen Riess, owenriess, quote, real estate, Realtor, Refinance, Reward, Riess, Social Media, Streamline, swimming pool, Twitter, Veteran | posted in Existing Homeowners, Family & Friends, First Time Homeowner, Frist Time Homebuyers, Mortgage Professional, Realtors, Social Media, Social Media for Realtors, Social Medis for Mortgage Originators

Effective January 1, 2014, the Minnesota Radon Awareness Act requires additional disclosure and education be provided to potential home buyers during residential real estate transactions in Minnesota. Before signing a purchase agreement to sell or transfer residential real property, the seller shall disclose in writing to the buyer any knowledge the seller has of radon concentrations in the dwelling.

Effective January 1, 2014, the Minnesota Radon Awareness Act requires additional disclosure and education be provided to potential home buyers during residential real estate transactions in Minnesota. Before signing a purchase agreement to sell or transfer residential real property, the seller shall disclose in writing to the buyer any knowledge the seller has of radon concentrations in the dwelling.

What is radon?

Radon is a colorless, odorless radioactive gas that seeps up from the earth. When inhaled, it gives off radioactive particles that can damage the cells that line the lung. Long term exposure to radon can lead to lung cancer. In fact, over 21,000 lung cancer deaths in the US each year are from radon, making it a serious health concern for all Minnesotans.

Radon comes from the soil. Radon is produced from the natural decay of uranium that is found in nearly all soils. Uranium breaks down to radium. As radium disintegrates it turns into radioactive gas…radon. As a gas, radon moves up through the soil and into the air you breathe. Radon is the number one cause of lung cancer in non-smokers and the second leading cause of lung cancer (after tobacco) in smokers. Thankfully, this risk should be entirely preventable through awareness and testing.

While radon is present everywhere, and there is no known, safe level, your greatest exposure is where it can concentrate-indoors and where you spend most time-at home. Homes can have radon whether it be old or new, well-sealed or drafty, and with or without a basement. Two components that affect how much radon will accumulate in a home are pathways and air pressure.

Please feel free to call me concnerning any home buying questions.

Thank you!

Owen Riess, Loan Officer

NMLS #543286 cell 952-240-3020

Leave a comment | tags: Buying, For Sale, Friend, God, Home, Home Ownership, Homeowner, House, Listing, Minnesota, Mortgage, Owen, Owen Riess, Radon, real estate, Realtor, Refinance, Regulations, Reward, Riess, Selling, Social Media, Streamline | posted in Existing Homeowners, Family & Friends, First Time Homeowner, Frist Time Homebuyers, Mortgage Professional, Realtors, Social Media, Social Media for Realtors, Social Medis for Mortgage Originators

The kids are back in school, the weather is getting cooler and your yard is covered in a layer of fallen leaves. Yep, it’s that time of the year again, but don’t think of fall leaves as a chore. They can be a useful resource for fertilizing your lawn or even decorating your home for autumn.

The kids are back in school, the weather is getting cooler and your yard is covered in a layer of fallen leaves. Yep, it’s that time of the year again, but don’t think of fall leaves as a chore. They can be a useful resource for fertilizing your lawn or even decorating your home for autumn.

Finish The Raking

It’s tempting to just let the leaves lie in the yard. It’s good fertilizer anyway, right? Wrong. You should rake everything up as soon as the trees begin to look bare, or else risk the blanket of leaves smothering your lawn over the winter season. Gather them up in plastic bags and put them to use.

Refuse To Rake Leaves

If you can’t bring yourself to pick up a rake, you do have an alternative. Wait until the leaves are dry and crunchy and fire up the lawnmower once more before winter. Many mowers have a mulch setting that will chop the fallen leaves to bits.

The smaller pieces won’t suffocate your lawn, and the crushed leaves make a good fertilizer. If you’d rather use the leaf bits in the garden or a flowerbed, use a grass clipping catcher with your mower to gather up the pieces as you mow.

Use Mulch And Fertilizer

Fresh chopped leaves are a good homemade mulch. Put a layer on the garden and the flower bed to replenish the soil over winter. Also, be sure to put a thick layer around young trees and shrubs to keep them warm. If you really want to get the most out of your leaves, then take them to the compost pile.

Mix the leaves in with the regular green yard waste, and the leaves will boost the composting process into overdrive. The fully composted material makes a potent fertilizer.

Get Crafty

Set some leaves aside to take indoors. The changing colors of the fall leaves are part of the beauty of autumn. Why not bring some of that beauty into the house?

Fill a vase with leaves for a seasonal centerpiece, or use a wire frame to make a wreath for the front door. You can make leaf etchings with the kids or simply use one as a bookmark.

It’s sad to see so many fall leaves burned up in piles, or put out with the trash. The leaves on the lawn aren’t just a mess to be cleaned up. Inside or outdoors, autumn leaves are an easy, natural, and free material. Be sure to put them to use!

Owen Riess | Mortgage Loan Originator NMLS # 543286

Leave a comment | tags: adventure, America, Facebook, Fannie Mae, For Sale, Freddie Mac, Friend, God, Home, Home Ownership, Homeowner, House, LinkedIn, Listing, Minnesota, Mortgage, Owen, Owen Riess, real estate, Realtor, Refinance, Reward, Riess, Social Media, Streamline, Twitter, Veteran, YouTube | posted in Existing Homeowners, Family & Friends, First Time Homeowner, Frist Time Homebuyers, Mortgage Professional, Motorcycle Travel Adventure, Realtors, Social Media, Social Media for Realtors

You’ve been searching for the perfect home for quite a while, and finally, you’ve found it! You get all of your finances in order and place an offer on the house.

You’ve been searching for the perfect home for quite a while, and finally, you’ve found it! You get all of your finances in order and place an offer on the house.

However, you’re not the only one that loves the home, because there are multiple offers — and one of them is cash.

Cash buyers are seen as desirable because they’re almost always a guaranteed quick close.

They don’t have to borrow money from a bank therefore won’t have any financing hang-ups, which is where a large portion of offers fall through. Don’t worry; not all hope is lost.

Follow the steps below to beef up your offer and get your foot in the door.

Less Expensive Homes

If you’ve put offers in on homes at the asking price and are continually beat out by buyers that are paying more, then you might want to consider looking in a lower price range. This is an especially smart strategy for those living in fast-selling markets. By looking at less expensive homes, you can be the one that puts in an offer over the asking price.

20 Percent Down Payment

Save up a higher down payment for the price range of homes you’re considering. If you can come up with 20 percent, then you’re in a position to wave the appraisal contingency for financing with the bank. The more you have in cash, the better.

Take-It-Or-Leave-It Home Inspection

This means that based on the home inspection, you’ll take the property with all its issues, or you’ll walk away. What you won’t do is ask the seller to waste more of their time and money fixing every little problem that’s found.

Fees

Waive the seller concessions, such as closing costs and the home warranty, and pay your real estate broker’s fees. These extra costs add up in the mind of the seller and will show that you really want the property.

Going up against cash buyers can be extremely discouraging. But, just because they’re dealing in cash doesn’t mean they’ll get the property. Many investors think they can put in a low offer because they’re dealing in cash.

So show you’re serious about a property, follow the steps above and put in your best offer. You’ll be a homeowner soon enough!

Contact me and we will get you pre-approved right away. Owen Riess

oriess@marketplacehome.com or apply on-line at www.owenriess.marketplacehome.com

Leave a comment | tags: adventure, America, Fannie Mae, Fight, For Sale, Freddie Mac, Friend, God, Home, Home Ownership, Homeowner, House, LinkedIn, Listing, Minnesota, Mortgage, No MI, Owen, Owen Riess, quote, real estate, Realtor, Refinance, Reward, Riess, Social Media, Streamline, VA Financing, Veteran, Veteran Benefits, Zero Downpayment | posted in Existing Homeowners, Family & Friends, First Time Homeowner, Frist Time Homebuyers, Mortgage Professional, Social Media, Social Media for Realtors, Social Medis for Mortgage Originators

The old real estate cliche’ about “location, location, location” is true, as the area of the city where your home is located will have an impact on its future value as well as your lifestyle.

The old real estate cliche’ about “location, location, location” is true, as the area of the city where your home is located will have an impact on its future value as well as your lifestyle.

So what factors should you consider when you are choosing which neighborhoods to house hunt within?

Proximity to Your Daily Needs

If you work downtown, living out in the suburbs means that you will be adding time for a commute onto your day.

While this might be worth the cheaper prices for properties out of the town center, it is something to consider when making your decision.

You will also need to consider whether the house is near shopping centers, schools, doctors, dentists and other services that you will need regularly.

Planned Developments

When you are choosing a neighborhood to buy in, do some research into what developments are planned in the future for that part of town.

For example, you might be able to get a cheap price on a home that is out of the way, but a new proposed highway leading straight into the town center that will be built in the next five years could increase property values considerably.

Overall Atmosphere

Take a walk around the neighborhood where you are considering buying and get a sense of the overall atmosphere. Are there a lot of families living there? Are there green places to relax? Are people friendly and saying hello to you?

You want to live in a place where you feel welcome and comfortable.

Property Values

Different neighborhoods will have a range of house prices and you will want to look for something with the right balance of value.

Some areas of town will be very expensive but very nice; other areas will have cheap house prices but might not be as pleasant to live in. Take the time to find the neighborhood that is in the middle, where you will find the right house, and neighborhood, at a good price.

These are just a few of the factors to consider so that you can choose the right neighborhood to buy in.

For more information about buying a home, feel free to contact me your trusted mortgage professional today.

Owen Riess

Leave a comment | tags: America, Fannie Mae, For Sale, Freddie Mac, Friend, God, Home, Home Ownership, Homeowner, House, Listing, Location, Marketplace, Marketplace Home Mortgage, Minnesota, Mortgage, Owen, Owen Riess, real estate, Realtor, Refinance, Riess, Social Media, Streamline, Veteran | posted in Existing Homeowners, Family & Friends, First Time Homeowner, Frist Time Homebuyers, Mortgage Professional, Realtors, Social Media, Social Media for Realtors, Social Medis for Mortgage Originators

Getting the best mortgage financing for your new home can sometimes be a complicated process and, unfortunately, things can go wrong. Using a licensed and trusted mortgage loan originator can help alleviate many of these challenges.

Getting the best mortgage financing for your new home can sometimes be a complicated process and, unfortunately, things can go wrong. Using a licensed and trusted mortgage loan originator can help alleviate many of these challenges.

There are certain mistakes that many homebuyers make when applying for their mortgages that can seriously damage their chances of being approved. If you are aware of the most common mortgage issues, you will be better able to prevent them when applying for your own mortgage.

Make sure that you keep the following tips in mind when applying for a mortgage:

Making Large Purchases Before Closing On The Mortgage

Many homebuyers think that they are in the clear once the mortgage deal is approved and they move forward on another large purchase such as a car or home furnishings. However, it is best to hold off on all major purchases until the mortgage is finalized, as additional debt will change your “debt-to-income ratio” which could mean that you no longer qualify for the loan.

Many lenders pull your credit information right before funding, so avoid any big-ticket items until you have signed on the dotted line.

Switching Jobs During The Mortgage Loan Process

When deciding whether or not to approve your loan, the lender will look at your salary and your job stability. If you make a career move during the process of applying for the loan, this could make your income seem unstable and could cause the bank to decline your loan.

Stay in your job through your home closing date to reassure the bank that you have a stable income; you can always switch careers later.

Having No Credit Card

You might think that the fact that you have gotten by without a credit card for this long would be a positive thing in the mind of lenders. However, having no credit history at all makes lenders nervous, as they don’t know how you will handle credit when you have it.

Instead, get a credit card that you repay in full every month, which will help to show them you can manage your credit responsibly.

These are just a few examples of major mistakes that home buyers make when applying for a mortgage. If you can avoid these issues, you will find it much easier to buy a home.

As always, call me your trusted real estate professional today to discuss your personal situation and get the best advice on your upcoming home purchase!

Owen Riess

owenriess.marketplacehome.com

Leave a comment | tags: America, Fannie Mae, For Sale, Freddie Mac, Friend, God, Home, Home Ownership, Homeowner, LinkedIn, Listing, Minnesota, Mortgage, Owen, Owen Riess, Purchase, quote, real estate, Realtor, Refinance, Reward, Riess, Social Media, Streamline, Veteran | posted in Existing Homeowners, Family & Friends, First Time Homeowner, Frist Time Homebuyers, Mortgage Professional, Realtors, Social Media, Social Media for Realtors, Social Medis for Mortgage Originators

Paying off the mortgage on your home faster means that you will not only have the satisfaction of owning your own home sooner, you will also have the benefit of paying much less in interest over the years.

Paying off the mortgage on your home faster means that you will not only have the satisfaction of owning your own home sooner, you will also have the benefit of paying much less in interest over the years.

The faster you pay off your mortgage, the more money you can save, so here are some tips to accelerate your payment schedule.

Pay Your Mortgage Every Other Week (Bi-Weekly)

Did you know that if you take your monthly mortgage payment and divide it in half and then pay it every two weeks that you will end up making a full extra month of payments every year? This is called a bi-weekly payment program which has been around for a long time, and it’s still a good idea today!

You likely won’t notice the difference since the extra half payments occur in long months with bigger paychecks, but over the years this will end up saving you thousands of dollars in interest payments.

Make a Bigger Monthly Payment

Similar to the bi-weekly payment plan above, you can accomplish the goal by dividing your principal and interest portion of your payment by 12 and then adding that amount to your regular monthly payment. You will be paying that extra payment every year, but spacing it out over each monthly payment.

Most homeowners using this tactic can shorten their term by up to seven years.

Put Any Windfall Toward the Mortgage

Was your tax rebate larger than you expected? Have you received an inheritance from your great aunt Rose? Have you won a cash prize in a contest?

Put any unexpected chunks of cash straight toward your mortgage instead of spending them. This won’t affect your budget at all, because you were never expecting or counting on that money in the first place. But once again, it can make a huge difference in the overall amount of interest that you pay on your mortgage loan.

However, keep in mind your particular situation. Spending every last penny paying off your mortgage as quickly as possible might not be the best option for you if you have no emergency savings fund or if you have a credit card languishing with high interest debt.

It is usually more important to deal with these pressing financial issues before attempting to save money on your mortgage. One great way to start your research on how to pay your home off faster is to talk with your trusted mortgage professional. I can answer your questions and point you in the best direction for your situation.

Don’t hesitate to contact me with questions or just to catch up on what’s going on in the mortgage industry.

Owen Riess

Leave a comment | tags: America, Debt Free, Fannie Mae, For Sale, Freddie Mac, Friend, God, Home, Home Ownership, Homeowner, LinkedIn, Listing, Minnesota, Mortgage, Owen, Owen Riess, quote, real estate, Realtor, Refinance, Reward, Riess, Social Media, Streamline, Veteran | posted in Existing Homeowners, Family & Friends, First Time Homeowner, Frist Time Homebuyers, Mortgage Professional, Realtors, Social Media, Social Media for Realtors, Social Medis for Mortgage Originators

Buying a foreclosed or REO property can be different than buying other types of real estate. In some cases you will be able to get a fantastic deal on a home, but you will need to go through quite a bit of work and negotiation.

Buying a foreclosed or REO property can be different than buying other types of real estate. In some cases you will be able to get a fantastic deal on a home, but you will need to go through quite a bit of work and negotiation.

Here are four tips to help you navigate the foreclosure buying process:

Find the right real estate agent

The first thing to keep in mind is that your real estate representative will deal directly with the bank that owns the foreclosed property. The bank has the final say in whether they’ll accept your bid – so you want an agent who has developed a good relationship with them, and a good understanding of the process.

Know that cheap doesn’t mean good value

Sometimes the tiny price tag on a foreclosed property can be very tempting, but make sure you are asking questions about the value and the potential expenses of the house. Will it require extensive repairs? Will you be able to find a tenant? Does the property have potential for appreciation over time?

Perform a house inspection

If the previous owners were foreclosed on because they couldn’t make their mortgage payments, it’s possible they didn’t have enough money to give the home the proper maintenance it needed. Make sure you have the property inspected by a professional to identify any problems. Serious problems can quickly turn your bargin into a cash gussler. Take extra care if the house has been empty for a while, as there could be problems with plumbing, insects or mold.

Look for intentional damage

Keep in mind that many owners were forced out of their property by the bank, so they might have removed as many appliances, light fixtures and other items as they could which usually means the house is stripped bare. The previous owners might have been angry and felt justified in damaging the property. Make sure to do a thorough inspection to find out what appliances you’ll need to buy and messes you’ll need to clean up.

If you are considering buying an REO property or a home in foreclosure, you might possibly get a great deal on a house with a lot of potential. Make sure you follow these tips and contact me for the referral of a licensed and trusted real estate professional for more information about buying a foreclosed property.

Welcome to Spring. Owen

Leave a comment | tags: America, Fannie Mae, For Sale, Freddie Mac, God, Home, Home Ownership, Homeowner, Listing, Minneapolis, Minnesota, Mortgage, Owen, Owen Riess, quote, real estate, Refinance, REO Property, Reward, Riess, Social Media, Streamline, Veteran | posted in Existing Homeowners, Family & Friends, First Time Homeowner, Frist Time Homebuyers, Mortgage Professional, Realtors, Social Media, Social Media for Realtors, Social Medis for Mortgage Originators

LinkedIn highlights your expertise and brings you exposure to thousands and even millions of people. Maintaining an active and current LinkedIn profile is essential in helping to grow your business. Following are four strategies to freshen up your LinkedIn Profile.

LinkedIn highlights your expertise and brings you exposure to thousands and even millions of people. Maintaining an active and current LinkedIn profile is essential in helping to grow your business. Following are four strategies to freshen up your LinkedIn Profile.

1. List Your Employment History – LinkedIn is like your experience calling card to build relationships. Make sure you have at least a ten year history. Clients and referral sources can’t guess where you previously worked or if you’re stable and qualified to be their lender or trusted referral partner.

2. Don’t Be Creative, Be Straight Forward – Complete your Title and Profile. This is the time to be as clear as possible. You may want to garnish your profile with creativity but instead make your title something a ten year old would be able to understand, and write your profile in clear and concise sentences. This helps enhance your exposure in the search engines as well as keeping you on target.

3. Connect – Don’t be shy to engage. Connect with people you know, people from your past and even people you don’t know. Be a part of groups from work, outside interests, high school, and college. Join groups from your area and industry. You never know who knows who, or who knows who you want to know. This is one of the best ways to expand your professional life and let people know what you do. However, choose your groups wisely as LinkedIn only allows you to join 50 groups.

4. Update – LinkedIn isn’t just a static site to expose your professionalism and expertise to the world. Engage and login daily or weekly. Think of it like your primary social media account but for your career. Connect with your contacts and engage. Take a minute to congratulate someone on their success or even engage back to a question or comment. This can help you gain publicity to people you don’t know and even keep you fresh in the minds of people you do know.

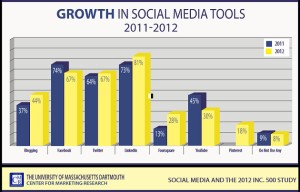

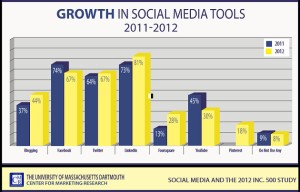

LinkedIn is the most popular social media tool among the nation’s fastest-growing companies, according to a study by the University of Massachusetts at Dartmouth, Center for Marketing Research, under the direction of researcher Nora Barnes, PhD. More than 8 in 10 companies listed on the 2012 Inc. 500 (81% of them) use the professional networking site, up from 73% a year earlier. (See above chart)

And, this is where your clients and future customers will come from..

Owen

Leave a comment | tags: adventure, America, Brother, Fannie Mae, For Sale, Freddie Mac, Friend, God, Home, Home Ownership, Homeowner, LinkedIn, Listing, Minnesota, Mortgage, Owen, Owen Riess, real estate, Refinance, Reward, Riess, Social Media, Streamline, Veteran | posted in Existing Homeowners, Family & Friends, First Time Homeowner, Frist Time Homebuyers, Mortgage Professional, Realtors, Social Media, Social Media for Realtors, Social Medis for Mortgage Originators

Spring is around the corner, really it is, and it’s time to get your home in order!

Spring is around the corner, really it is, and it’s time to get your home in order!